10 Year Fixed Rate Mortgage Calculator

Use this free tool to figure your monthly payments on a 10-year FRM for a given loan amount. Current El Monte 10-year mortgage rates are shown beneath the calculator.

Current El Monte 10-Year Mortgage Rates on a $320,000 Home Loan

The following table highlights current El Monte mortgage rates. By default 10-year purchase loans are displayed. Clicking on the refinance button switches loans to refinance. Other loan adjustment options including price, down payment, home location, credit score, term & ARM options are available for selection in the filters area at the top of the table.

Amortization Schedule for a $320,000.00 10-Year FRM Refi Home Loan @ 6.50% APR

| Year | Month | Interest | Principal | Balance |

|---|---|---|---|---|

| 1 | 1 | $1,733.33 | $1,900.20 | $318,099.80 |

| 1 | 2 | $1,723.04 | $1,910.49 | $316,189.30 |

| 1 | 3 | $1,712.69 | $1,920.84 | $314,268.46 |

| 1 | 4 | $1,702.29 | $1,931.25 | $312,337.21 |

| 1 | 5 | $1,691.83 | $1,941.71 | $310,395.50 |

| 1 | 6 | $1,681.31 | $1,952.23 | $308,443.28 |

| 1 | 7 | $1,670.73 | $1,962.80 | $306,480.48 |

| 1 | 8 | $1,660.10 | $1,973.43 | $304,507.04 |

| 1 | 9 | $1,649.41 | $1,984.12 | $302,522.92 |

| 1 | 10 | $1,638.67 | $1,994.87 | $300,528.05 |

| 1 | 11 | $1,627.86 | $2,005.67 | $298,522.38 |

| 1 | 12 | $1,617.00 | $2,016.54 | $296,505.84 |

| Year 1 | $20,108.26 | $23,494.16 | $296,505.84 | |

| 2 | 1 | $1,606.07 | $2,027.46 | $294,478.38 |

| 2 | 2 | $1,595.09 | $2,038.44 | $292,439.93 |

| 2 | 3 | $1,584.05 | $2,049.49 | $290,390.45 |

| 2 | 4 | $1,572.95 | $2,060.59 | $288,329.86 |

| 2 | 5 | $1,561.79 | $2,071.75 | $286,258.11 |

| 2 | 6 | $1,550.56 | $2,082.97 | $284,175.14 |

| 2 | 7 | $1,539.28 | $2,094.25 | $282,080.89 |

| 2 | 8 | $1,527.94 | $2,105.60 | $279,975.29 |

| 2 | 9 | $1,516.53 | $2,117.00 | $277,858.29 |

| 2 | 10 | $1,505.07 | $2,128.47 | $275,729.82 |

| 2 | 11 | $1,493.54 | $2,140.00 | $273,589.82 |

| 2 | 12 | $1,481.94 | $2,151.59 | $271,438.23 |

| Year 2 | $18,534.81 | $25,067.61 | $271,438.23 | |

| 3 | 1 | $1,470.29 | $2,163.24 | $269,274.98 |

| 3 | 2 | $1,458.57 | $2,174.96 | $267,100.02 |

| 3 | 3 | $1,446.79 | $2,186.74 | $264,913.28 |

| 3 | 4 | $1,434.95 | $2,198.59 | $262,714.69 |

| 3 | 5 | $1,423.04 | $2,210.50 | $260,504.19 |

| 3 | 6 | $1,411.06 | $2,222.47 | $258,281.72 |

| 3 | 7 | $1,399.03 | $2,234.51 | $256,047.21 |

| 3 | 8 | $1,386.92 | $2,246.61 | $253,800.60 |

| 3 | 9 | $1,374.75 | $2,258.78 | $251,541.82 |

| 3 | 10 | $1,362.52 | $2,271.02 | $249,270.80 |

| 3 | 11 | $1,350.22 | $2,283.32 | $246,987.48 |

| 3 | 12 | $1,337.85 | $2,295.69 | $244,691.80 |

| Year 3 | $16,855.99 | $26,746.43 | $244,691.80 | |

| 4 | 1 | $1,325.41 | $2,308.12 | $242,383.67 |

| 4 | 2 | $1,312.91 | $2,320.62 | $240,063.05 |

| 4 | 3 | $1,300.34 | $2,333.19 | $237,729.86 |

| 4 | 4 | $1,287.70 | $2,345.83 | $235,384.02 |

| 4 | 5 | $1,275.00 | $2,358.54 | $233,025.49 |

| 4 | 6 | $1,262.22 | $2,371.31 | $230,654.17 |

| 4 | 7 | $1,249.38 | $2,384.16 | $228,270.01 |

| 4 | 8 | $1,236.46 | $2,397.07 | $225,872.94 |

| 4 | 9 | $1,223.48 | $2,410.06 | $223,462.88 |

| 4 | 10 | $1,210.42 | $2,423.11 | $221,039.77 |

| 4 | 11 | $1,197.30 | $2,436.24 | $218,603.54 |

| 4 | 12 | $1,184.10 | $2,449.43 | $216,154.10 |

| Year 4 | $15,064.73 | $28,537.69 | $216,154.10 | |

| 5 | 1 | $1,170.83 | $2,462.70 | $213,691.40 |

| 5 | 2 | $1,157.50 | $2,476.04 | $211,215.36 |

| 5 | 3 | $1,144.08 | $2,489.45 | $208,725.91 |

| 5 | 4 | $1,130.60 | $2,502.94 | $206,222.97 |

| 5 | 5 | $1,117.04 | $2,516.49 | $203,706.48 |

| 5 | 6 | $1,103.41 | $2,530.13 | $201,176.36 |

| 5 | 7 | $1,089.71 | $2,543.83 | $198,632.52 |

| 5 | 8 | $1,075.93 | $2,557.61 | $196,074.92 |

| 5 | 9 | $1,062.07 | $2,571.46 | $193,503.45 |

| 5 | 10 | $1,048.14 | $2,585.39 | $190,918.06 |

| 5 | 11 | $1,034.14 | $2,599.40 | $188,318.67 |

| 5 | 12 | $1,020.06 | $2,613.48 | $185,705.19 |

| Year 5 | $13,153.51 | $30,448.91 | $185,705.19 | |

| 6 | 1 | $1,005.90 | $2,627.63 | $183,077.56 |

| 6 | 2 | $991.67 | $2,641.87 | $180,435.69 |

| 6 | 3 | $977.36 | $2,656.18 | $177,779.52 |

| 6 | 4 | $962.97 | $2,670.56 | $175,108.95 |

| 6 | 5 | $948.51 | $2,685.03 | $172,423.93 |

| 6 | 6 | $933.96 | $2,699.57 | $169,724.35 |

| 6 | 7 | $919.34 | $2,714.20 | $167,010.16 |

| 6 | 8 | $904.64 | $2,728.90 | $164,281.26 |

| 6 | 9 | $889.86 | $2,743.68 | $161,537.58 |

| 6 | 10 | $875.00 | $2,758.54 | $158,779.04 |

| 6 | 11 | $860.05 | $2,773.48 | $156,005.56 |

| 6 | 12 | $845.03 | $2,788.51 | $153,217.06 |

| Year 6 | $11,114.29 | $32,488.13 | $153,217.06 | |

| 7 | 1 | $829.93 | $2,803.61 | $150,413.45 |

| 7 | 2 | $814.74 | $2,818.80 | $147,594.65 |

| 7 | 3 | $799.47 | $2,834.06 | $144,760.59 |

| 7 | 4 | $784.12 | $2,849.42 | $141,911.17 |

| 7 | 5 | $768.69 | $2,864.85 | $139,046.32 |

| 7 | 6 | $753.17 | $2,880.37 | $136,165.95 |

| 7 | 7 | $737.57 | $2,895.97 | $133,269.98 |

| 7 | 8 | $721.88 | $2,911.66 | $130,358.33 |

| 7 | 9 | $706.11 | $2,927.43 | $127,430.90 |

| 7 | 10 | $690.25 | $2,943.28 | $124,487.62 |

| 7 | 11 | $674.31 | $2,959.23 | $121,528.39 |

| 7 | 12 | $658.28 | $2,975.26 | $118,553.13 |

| Year 7 | $8,938.50 | $34,663.92 | $118,553.13 | |

| 8 | 1 | $642.16 | $2,991.37 | $115,561.76 |

| 8 | 2 | $625.96 | $3,007.58 | $112,554.18 |

| 8 | 3 | $609.67 | $3,023.87 | $109,530.32 |

| 8 | 4 | $593.29 | $3,040.25 | $106,490.07 |

| 8 | 5 | $576.82 | $3,056.71 | $103,433.36 |

| 8 | 6 | $560.26 | $3,073.27 | $100,360.09 |

| 8 | 7 | $543.62 | $3,089.92 | $97,270.17 |

| 8 | 8 | $526.88 | $3,106.66 | $94,163.51 |

| 8 | 9 | $510.05 | $3,123.48 | $91,040.03 |

| 8 | 10 | $493.13 | $3,140.40 | $87,899.63 |

| 8 | 11 | $476.12 | $3,157.41 | $84,742.21 |

| 8 | 12 | $459.02 | $3,174.51 | $81,567.70 |

| Year 8 | $6,616.99 | $36,985.43 | $81,567.70 | |

| 9 | 1 | $441.83 | $3,191.71 | $78,375.99 |

| 9 | 2 | $424.54 | $3,209.00 | $75,166.99 |

| 9 | 3 | $407.15 | $3,226.38 | $71,940.61 |

| 9 | 4 | $389.68 | $3,243.86 | $68,696.75 |

| 9 | 5 | $372.11 | $3,261.43 | $65,435.33 |

| 9 | 6 | $354.44 | $3,279.09 | $62,156.23 |

| 9 | 7 | $336.68 | $3,296.86 | $58,859.38 |

| 9 | 8 | $318.82 | $3,314.71 | $55,544.66 |

| 9 | 9 | $300.87 | $3,332.67 | $52,211.99 |

| 9 | 10 | $282.81 | $3,350.72 | $48,861.27 |

| 9 | 11 | $264.67 | $3,368.87 | $45,492.40 |

| 9 | 12 | $246.42 | $3,387.12 | $42,105.29 |

| Year 9 | $4,140.01 | $39,462.41 | $42,105.29 | |

| 10 | 1 | $228.07 | $3,405.46 | $38,699.82 |

| 10 | 2 | $209.62 | $3,423.91 | $35,275.91 |

| 10 | 3 | $191.08 | $3,442.46 | $31,833.45 |

| 10 | 4 | $172.43 | $3,461.10 | $28,372.35 |

| 10 | 5 | $153.68 | $3,479.85 | $24,892.50 |

| 10 | 6 | $134.83 | $3,498.70 | $21,393.80 |

| 10 | 7 | $115.88 | $3,517.65 | $17,876.14 |

| 10 | 8 | $96.83 | $3,536.71 | $14,339.44 |

| 10 | 9 | $77.67 | $3,555.86 | $10,783.57 |

| 10 | 10 | $58.41 | $3,575.12 | $7,208.45 |

| 10 | 11 | $39.05 | $3,594.49 | $3,613.96 |

| 10 | 12 | $19.58 | $3,613.96 | $0.00 |

| Year 10 | $1,497.14 | $42,105.29 | $0.00 | |

How 10-Year Fixed-Rate Mortgages Can Work for You

Homeownership requires adequate financial preparation. On top of saving a substantial down payment, you must have a good credit score to qualify for a mortgage. And depending on your income and other debt obligations, mortgage originators decide how much they are willing to lend.

Besides preparing your finances, it’s equally important to understand your mortgage options before signing any deal. In particular, factors such as your loan term, which is the assigned payment duration of your mortgage, can affect your monthly payment and overall interest expenses.

Common loan terms chosen by homebuyers are 30-year and 15-year fixed-rate mortgages. But did you know you could obtain a 10-year fixed-rate loan? If you want to pay your mortgage a lot sooner, consider this option.

Our article will discuss how 10-year fixed mortgages work, including their benefits and disadvantages. We’ll also explain when it’s a good idea to choose this type of loan, and when it makes sense to refinance to a shorter term. We’ll also compare payments between 10-year, 15-year, and 30-year fixed-rate mortgages.

Understanding How 10-Year Fixed Mortgages Work

A 10-year fixed mortgage is a home loan that’s paid within a period of 10 years. Because it’s a fixed-rate mortgage (FRM), it maintains the same interest rate for the entire loan duration. In contrast, adjustable-rate mortgages (ARM) have rates that are subject to shift periodically when market rates change.

Since FRMs have secured rates, monthly principal and interest payments remain the same for 10 years. While other fees such as property taxes and home insurance may increase, the locked rate ensures your monthly payment stays affordable throughout the term. And because your payments are predictable, it’s easy to track your payment schedule and plan your budget.

Fixed rate mortgages follow a traditional amortization schedule. This is a payment record that details the precise number of payments you need to make on your mortgage. For example, 10-year FRMs come with 120 payments spread throughout 10 years, while a 15-year FRMs require 180 payments spread across 15 years. A 30-year FRM requires a total of 360 payments spread throughout 30 years. The amortization schedule also includes how much of your payments are applied to your loan’s interest and principal payments.

- Principal: The loan amount or the money you borrowed from your lender is called the principal. This indicates how much you still owe before completely paying off your mortgage.

- Interest: Lenders charge interest to earn a profit from your loan. It’s the amount you pay for borrowing money for your mortgage. Borrowing a higher principal amount generates higher interest costs. Taking a longer term to pay off your debt also results in higher interest charges. For this reason, a 10-year FRM charges significantly lower interest expenses than a 30-year FRM.

If you need to generate a sample amortization schedule, use the above calculator.

To determine the full monthly payment on your mortgage, you must also add the following housing costs to your principal and interest payments:

- Real estate taxes

- Homeowners insurance

- Private mortgage insurance (PMI)

- Maintenance costs

- Homeowner’s associate dues (HOA)

For fixed-rate mortgages, a large portion of your monthly payment goes toward interest during the first years of the loan. This diminishes your principal balance at a slower pace. However, during the latter half of the term, more of your payments go toward the principal. When your principal is reduced faster, it decreases your interest charges. As long as you keep making payments according to schedule, your mortgage should be paid off within 10 years.

Comparing 10-Year FRM Rates with Other Terms

Expect 10-year fixed mortgages to have lower rates compared to longer terms. In January 2021, 10-year FRM rates can be around 0.5% lower than a 30-year FRM, and around 0.2% lower than a 15-year FRM. The following chart shows average mortgage rates for different fixed-rate terms as of January 12, 2021:

| Fixed-Rate Mortgage (FRM) | Rate (APR) |

|---|---|

| 10-year | 2.33% |

| 15-year | 2.35% |

| 20-year | 2.78% |

| 30-year | 2.87% |

On the other hand, lenders assign the highest rates to 30-year FRMs. Since extended terms take longer to pay down, the lender takes on more duration risk when they secure your mortgage. With a longer term, a borrower has more chances of defaulting on their mortgage than a shorter period. Moreover, the dollar value decreases over time due to inflation. Thus, lenders impose higher rates on loans with longer terms.

Paying your mortgage faster is one of the biggest advantages of 10-year FRMs is. It also results in lower interest expenses compared to a 30-year FRM. But as a compromise, you must be prepared to make higher monthly payments. This makes them less appealing to first-time homebuyers and other consumers with limited funds.

10-year fixed mortgages are usually offered by conventional loan lenders. These types of loans come with strict qualifying standards to ensure borrowers have a reliable source of income. Thorough assessment of your financial background before approval helps lenders reduce their default risk.

A Brief Background on Conventional Mortgages

Close to 70% of all homebuyers in the US use conventional loans to finance home purchases. Conventional mortgages are a type of financing that is not directly funded by the government. These loans are commonly bundled into mortgage-backed securities by Fannie Mae and Freddie Mac.

You can obtain conventional mortgages from banks, mortgage companies, and credit unions. Conventional mortgages come in two types of loans, these are conforming conventional loans and non-conforming conventional loans. Conforming conventional loans are mortgages that fall within the loan limit required by the Federal Finance Housing Agency (FHFA). Meanwhile, non-conforming conventional loans or jumbo mortgages exceeds the loan limit assigned by the FHFA. These are mortgages used by high-income borrowers to purchase expensive property.

For example, if your loan is $300,000 and the loan limit in your area is $647,200, your mortgage is secured as a conforming conventional mortgage. On the other hand, if your loan is higher than the required limit, it’s secured by your lender as a jumbo mortgage. Jumbo loans cannot be bought, guaranteed and securitized by Fannie Mae and Freddie Mac. For an updated list of conforming loan limits, homebuyers can go to the FHFA website.

Furthermore, borrowers are required to pay private mortgage insurance (PMI) when they pay below 20% down on their home’s purchase price. PMI is an extra charge that protects conventional loan lenders in case borrowers have trouble making mortgage payments. It’s usually rolled into mortgage payments, which costs around 0.25% to 2% of the loan annually. PMI is automatically removed once a borrower’s loan-to-value ratio reaches 78%.

Are 10-Year FRMs Commonly Used by Borrowers?

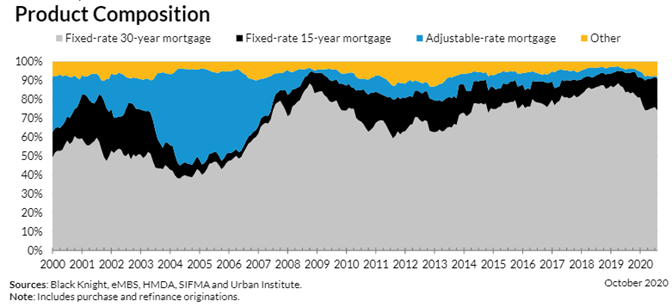

Because shorter mortgage terms require higher monthly payments, 10-year fixed mortgages are not a popular choice among homebuyers. The most widely used loan purchase product in the US is the 30-year fixed-rate mortgage. The extended term comes with cheaper monthly payments compared to shorter terms. This is followed by the 15-year fixed mortgage, which is also commonly used as a refinancing tool by borrowers.

The following graph shows the market share of different US mortgage products in October 2020. The data was reported by the Urban Institute from Housing Finance at a Glance: A Monthly Chartbook, released in December 2020.

| Mortgage Product | Market Share (October 2020) |

|---|---|

| 30-Year FRM | 74.2% |

| 15-Year FRM | 16.9% |

| ARM | 0.9% |

| Other (10 & 20-year fixed terms, etc.) | 8% |

10-year fixed mortgages do not take a large portion of the housing market share. Based on the data, the most purchased type of mortgage in October 2020 is the 30-year FRM, which accounted for 74.2% of new originations. In second place were 15-year FRMs which comprised 16.9% of new loan originations. Meanwhile, ARMs accounted for only 0.9% of the market, while 8% of the market share was comprised of other mortgage products, such as 20-year and 10-year fixed-rate loans.

The Urban Institute describes 15-year FRMs primarily as refinancing products. In October 2019, the 15-year FRM market share was only at 10.1%. But by October 2020, this rose to 16.9%, indicating high occurrence of refinances in the mortgage market.

In 2020, many borrowers rushed to refinance their mortgage as rates fell to historic lows. Record low rates were caused by the COVID-19 crisis as unemployment rose and markets declined. To aid economic recovery and market growth, the Federal Reserve announced it will keep benchmark rates close to zero until 2023.

To show how different loan terms impact mortgage expenses, see the table below. The following example compares rates, monthly principal and interest payments, and overall interest charges for a $220,000 mortgage. These calculations presume a 20% down payment on each loan. It does not factor in other housing costs such as property taxes, mortgage insurance, and homeowner’s insurance fees.

Loan Amount: $220,000

| Loan Term | 10-YR FRM | 15-YR FRM | 20-YR FRM | 30-YR FRM |

|---|---|---|---|---|

| Interest Rate (APR) | 2.871% | 2.877% | 3.343% | 3.545% |

| Monthly P&I Payment | $2,111.26 | $1,506.30 | $1,258.23 | $993.43 |

| Total Interest Costs | $33,351 | $51,134 | $81,976 | $137,636 |

As you notice, the monthly principal and interest payment decreases as the loan term is extended. In the example, the 10-year FRM has the highest monthly payment at $2,111.26. When the term is extended to 15 years, the monthly payment decreased to $1,506.30. That’s a reduction of $604.96. Meanwhile, if the term is extended to 30 years, the monthly payment is reduced to $993.43. This is cheaper by $1,117.83 than the 10-year FRM, which makes it more attractive to homebuyers.

However, interest costs are much lower with a shorter term compared to extended terms. This yields more savings over the life of the loan. The 10-year FRM only generates a total of $33,351 on interest costs. In contrast, interest charges for the 30-year FRM amounted to $137,636. In this scenario, if you take the 10-year FRM, you’ll save $104,285 on total interest expenses. That’s a lot of money that could go toward your emergency savings and retirement funds.

Mortgage Refinancing

While 10-year FRMs can be used to purchase homes, it’s typically used as a refinancing tool by borrowers. Refinancing allows homeowners to obtain a more favorable mortgage deal by changing their current loan. This lets borrowers shorten their current term and reduce their rate. Homeowners typically refinance their mortgage when general market rates significantly fall.

The most common type of loan used for refinancing is the 15-year FRM. While 15-year terms are not as short as a 10-year term, it still considerably shortens a 30-year fixed term. Furthermore, refinancing allows borrowers to shift from and adjustable-rate mortgage into a fixed-rate loan. They secure a lower fixed rate so they don’t have to worry about increasing monthly payments when market rates change. Borrowers also refinance to change from a government-backed loan into a conventional mortgage.

Government-backed mortgages such as FHA loans require borrowers to pay mortgage insurance premium (MIP). This is an added fee that protects the lender in case you default on your loan. It’s required for the entire payment term, and typically costs 0.85% of your loan annually. Borrowers can remove this expensive cost by refinancing into a conventional mortgage.

Be sure to save enough for closing costs. Because refinancing is essentially taking a new mortgage to replace your existing loan, it comes with expensive fees. The closing costs typically range from 3% to 6% of your loan amount. For example, if your mortgage is worth $200,000, expect your closing costs to be around $6,000 to $12,000. To breakeven faster on the cost of refinancing, you must secure a low enough rate. As a rule of thumb, financial experts advise refinancing 1 to 2 percentages lower than your current rate. The further you reduce your original rate, the more interest savings you’ll gain.

To qualify for refinancing, borrowers must have a credit score of at least 620. But to obtain a more favorable rate, it’s better to have a higher credit score of 700 and above. Before refinancing, make sure to improve your credit score. This can be done by paying bills on time, paying down large debts, and maintaining a smaller credit card balance.

Adverse Market Refinance Fee

Due to the COVID-19 pandemic, the global economy fell into a recession in 2020. Fannie Mae and Freddie Mac, which secure about 70% of all US mortgages, lost an estimated $6 billion due to the crisis. As a response, they required mortgage lenders to charge an adverse refinance market fee of 50 basis points. This extra fee was officially implemented in December 1, 2020 for all refinances. Those exempted from the fee are mortgages with balances below or equivalent to $125,000, including FHA and VA refis. Before refinancing, consider this extra charge.

When It Makes Sense to Get a 10-Year Fixed Mortgage

Taking a 10-year FRM is a viable option for homebuyers with large incomes and sterling credit scores. If you have ample savings to afford expensive monthly payments, it’s worth paying your mortgage a lot sooner. But as you’ve learned, 10-year FRMs are not common because it’s a costly loan option.

Though most homebuyers take a 30-year FRM, three decades is a very long time to be paying for debt. You’re likely to pay for your mortgage well into your senior years. To eliminate mortgage debt before retirement, some people choose a shorter term, or eventually refinance to reduce their term. On top of this, you’ll save tens and thousands of dollars on interest costs. Once you pay your mortgage early, you free up your income for more savings. You can prioritize emergency funds, retirement savings, and other profitable investments.

Furthermore, a short loan term allows you to gain home equity faster. This leverage makes it easier to borrow money for worthwhile causes. You can borrow against home equity to finance major expenses such as home improvements, funding your child’s college education, or paying for medical expenses.

More people opt for a 15-year FRM if they can afford to make higher payments. It comes with monthly payments that are not as high as 10-year terms. If your finances are too tight, you might have trouble making payments with a shorter term. So if you can afford a 15-year FRM, take that option instead. Before choosing a 10-year term, make sure you have enough room for expensive monthly payments in your budget.

Think of the Drawbacks

Prepare for tradeoffs when you choose a shorter term. This usually means qualifying for a much lower loan amount compared to a 30-year FRM. For example, depending on your income and other qualifications, you might qualify for a home priced at $350,000 with a 30-year FRM if you make a 20% down payment. But if you choose a 10-year term, this might reduce your loan amount to $250,000.

A smaller loan means you might have to look for a cheaper house just to fit your budget. For this reason, more homebuyers are drawn to 30-year FRMs, together with the cheaper monthly payments. On the other hand, if your take a 10-year FRM, you’ll pay a lower private mortgage insurance (PMI) than a 30-year term.

Next, while you’re prioritizing mortgage payments, you’ll likely have less money for savings. So before you take this option, make sure you have adequate emergency savings. You’ll never know when you’ll need funds to cover medical expenses for injuries or unexpected car repairs. If you’ve don’t have enough emergency funds, taking a 10-year FRM is not a practical option. In the meantime, you can choose a 30-year FRM. When you’ve built more income and improved your credit score, you can eventually refinance into a shorter term.

If you do not have enough room in your budget, do not take a 10-year FRM. Even if you qualify for a short term, you’ll have a hard time making payments especially if unexpected expenses arise. If you have trouble making payments, you might lose your home to foreclosure.

The following table summarizes the benefits and disadvantages of taking a 10-year fixed-rate mortgage:

| Pros | Cons |

|---|---|

| 10-year FRMs have lower rates than longer terms | People with lower income and credit score cannot qualify |

| The fixed rate guarantees monthly principal and interest payments stays the same | Comes with expensive monthly principal and interest payments |

| Pay your mortgage sooner, build home equity faster | You'll qualify for a smaller loan amount compared to a 30-year FRM |

| 10-year FRMs significantly save more interest costs compared to 30-year terms | Prioritizing mortgage payments keep you from investing in other profitable business ventures |

| If you pay less than 20% down on a 10-year FRM, you pay lower PMI than a 30-year FRM | It’s riskier if you face a medical emergency or sudden job loss |

Estimate and Compare Mortgage Payments

To know how varying loan terms affect the cost of your mortgage, let’s review the following example. This will help you determine if you can afford a shorter loan, or if it’s better to choose a 30-year term.

Suppose you bought a $300,000 house and offered a 20% down payment worth $60,000. Your mortgage will then amount to $240,000. Now, let’s compare your monthly payments if you choose between a 30-year FRM, 15-year FRM, and 10-year FRM.

Loan Amount: $240,000

| Loan Term | 10-YR FRM | 15-YR FRM | 30-YR FRM |

|---|---|---|---|

| Interest Rate (APR) | 2.33% | 2.35% | 2.87% |

| Monthly P&I Payment | $2,243.97 | $1,583.40 | $995.10 |

| Total Interest Costs | $29,276.67 | $45,012.50 | $118,236.23 |

Based on the results, with a 10-year FRM, your monthly principal and interest payment will be $2,243.97. If you can afford this type of mortgage, your total interest cost will be $29,276.67. This is a lot cheaper compared to the 15-year FRM which costs $45,012.50 in total interest, or the 30-year FRM which comes with $118,236.23 in overall interest expenses. With the 10-year term, you’ll save $88,959.56 compared to a 30-year term over the life of the loan.

However, if you cannot afford the monthly payment for the 10-year FRM, consider taking a 15-year FRM. With this option, your monthly principal and interest payment will be $1,583.40. This is more affordable by $660.57 than the 10-year option. And compared to the 30-year FRM, you’ll save $73,223.73 in overall interest charges. If the 15-year term is not an option, you can wait a few years to assess if you can refinance to a shorter term. Refinancing can work in your favor especially if market rates are generally low.

Other Ways to Reduce Your Payment Term

If you can’t obtain a short loan, there are other methods that can help reduce your payment term. You can do this by making extra mortgage payments toward your principal. Additional payments can reduce your principal significantly during the early years of your loan. Since most of your payment goes toward interest during the first couple of years, making extra payments to your principal diminishes it faster.

Making additional payments is also a more flexible method compared to a shorter term. While 10-year terms are usually $1,000 more expensive than a 30-year FRM, you can add any amount to a 30-year term. Whether you put an extra $50 or $200 each month, this can save you thousands of dollars in interest charges. And though it won’t cut your 30-year term in half, it will certainly shave a couple of years off your mortgage.

Beware of Prepayment Penalty

Talk to your lender about prepayment penalty before making extra payments. This penalty usually takes effect for the first three years of your mortgage. It’s required by many conventional lenders to discourage borrowers from refinancing, selling their home, or paying their mortgage early. Borrowers can wait for the penalty period to finish before making additional payments. Some lenders may let you pay up to 20% of the principal before triggering the penalty fee.

While you can obtain a conventional loan without a prepayment penalty clause, many lenders insist on imposing this rule. Other mortgage options that do not require prepayment penalties are government-backed mortgages, such as FHA loans, VA loans, and USDA loans.

In Summary

10-year fixed-rate mortgages are a good fit for homebuyers with pristine credit scores and high incomes. If you can afford to make higher mortgage payments, you should consider taking a short term. Borrowers may also refinance into a shorter term to reduce their current rate. 10-year fixed-rate loans have lower rates compared to 30-year and 15-year fixed-rate mortgages. This loan cuts more years off a 30-year term, and saves more interest expenses over the life of the loan. It’s a viable option if you want to gain home equity faster and pay down your mortgage before retirement.

However, taking a 10-year fixed mortgage has several drawbacks. Most homebuyers cannot take this option because of expensive monthly payments. It also means qualifying for a smaller loan amount, which will make it harder to purchase homes with higher prices. Because of this, many homebuyers take a 30-year fixed-rate mortgage instead.

After a couple of years, when borrowers build more income and improve their credit score, they have the option to refinance into a shorter term. This is most advantageous if market rates are generally low. Consider refinancing to a 10-year fixed mortgage if you can sufficiently afford the higher monthly payment.

El Monte Borrowers: Are You Unsure Which Loans You'll Qualify For?

We have partnered with Mortgage Research Center to help El Monte homebuyers and refinancers find out what loan programs they are qualified for and connect them with El Monte lenders offering competitive interest rates.